я. E-cigarette Industry Market Trends and Growth Potential Analysis

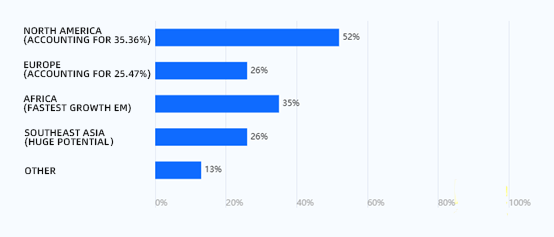

(я) Regional Growth Dynamics Differ Clearly

North America Leads in Growth:

According to e-cigarette industry surveys, 52% of participants believe that North America will remain the leading growth engine in the global e-cigarette industry over the next two years. This is largely due to its mature consumer base, favorable regulatory framework, and rapid adoption of AI vaping technology and compliance infrastructure.

Emerging Markets Follow Closely Behind:

Southeast Asia and Africa show promising growth, selected by 31% of respondents as key development regions. Their youthful demographics and rising consumer purchasing power support a new wave of vape market expansion.

II. Technological Innovation and Product Development Direction

(я) Dual-Driven by Intelligence and Sustainability

| Technological Innovation Direction | Market Preference Rate | Core Value |

| AI-Powered Personalized Experience | 68% | Enable flavor customization and usage behavior analysis for scenario-based services |

| Eco-Friendly Design | 55% | Use of recyclable materials and low-power chips for green solutions |

| Smart Temperature Control Technology | 32% | Precise temperature regulation to enhance flavor consistency |

These innovations are reshaping the e-cigarette industry, aligning it with global demands for health-conscious, eco-friendly e-cigarette products.

(II) Regional Market-Specific Technology Adoption

In North America, brands emphasize AI-driven personalization, while emerging regions prioritize affordable, foundational technologies. Companies must adjust vape product development to align with local consumer needs and regulatory expectations.

III. Policy and Regulatory Compliance Strategies

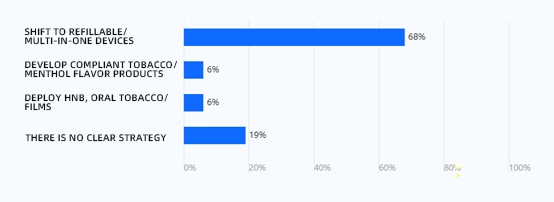

(я) Business Response to Regulatory Bans

In response to disposable vape bans, 68% of companies have shifted toward refillable e-cigarette systems with modular, multi-functional designs. This approach reduces regulatory risks while promoting product lifecycle sustainability.

(II) Key Risks for Chinese Exporters

Flavored Vape Restrictions: EU and U.S. flavor bans have increased compliance costs by over 30% for fruit-flavored SKUs.

Age Verification Technology: The EU’s TPD now mandates smart-lock systems, raising per-unit hardware costs by up to $15.

Navigating these challenges is crucial for global brands seeking to maintain regulatory compliance in the vape industry.

IV. Supply Chain Bottlenecks and Breakthrough Pathways

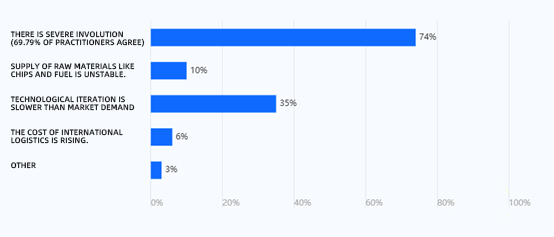

(я) Intensified Competition as a Core Challenge

Data Evidence: 69.79% of industry professionals cite homogenized competition as the key cause of falling margins. 74% of companies experience pricing pressure in the OEM vape manufacturing space.

(II) Collaborative Solutions for Supply Chain Optimization

Forming industry alliances to standardize key components (e.g., atomizers, батарейки) can reduce complexity.

Establishing cross-border production capacity in countries like Vietnam and Mexico can lower tariff impact and regulatory friction.

Such strategies are essential for improving vape supply chain efficiency and cost competitiveness.

В. Consumer Demand Evolution and Competitive Focus

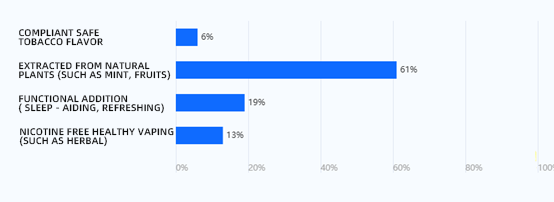

(я) Deep Dive into Flavor Preferences

Natural Extracts Dominate: 61% of consumers favor natural flavor extracts, such as mint and fruit. This indicates ongoing demand for flavored vape products, despite increasing bans.

(II) 2025 Competitive Dimensions for Brands

| Competitive Element | Attention from Top Brands | Implementation Path |

| Innovation Speed | 32% | Establish a quarterly R&D mechanism and invest in AI automation algorithms |

| Regional Localization | 32% | Hire local teams for channel development and compliance management |

| Health and Safety Certification | 28% | Apply for international safety certifications such as PMTA and TGA |

Strong branding in health-focused e-cigarette solutions and local adaptation remains crucial in competitive positioning.

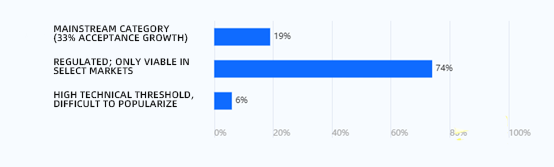

VI. Alternative Markets and Industry Transformation

(я) Industrial Hemp E-Cigarettes Development Outlook

Regulatory Constraints: 74% of respondents believe hemp-based vaping will only scale in policy-friendly markets (e.g., Canada, U.S.). THC content limitations remain a barrier to wider adoption.

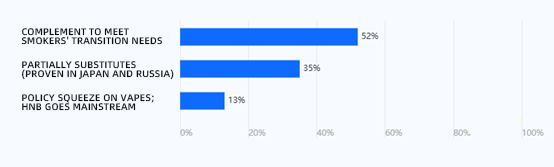

(II) Relationship Between HNB and E-Cigarettes

Complementary Relationship: 52% of participants view HNB products and traditional e-cigarettes as complementary. HNB caters to premium, tobacco-alternative users, while e-cigarettes appeal to younger, tech-driven consumers.

Brands that differentiate across both categories may achieve better market penetration.

VII. Capital Trends and Industry Confidence

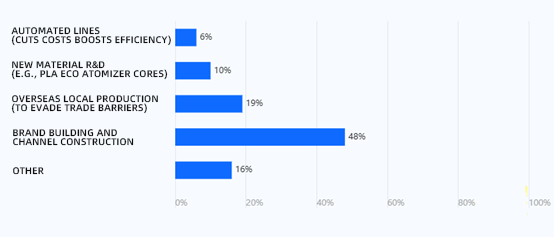

(я) Corporate Investment Priorities

Brand and Channel Development: 48.0% of companies plan to expand offline retail stores and invest in KOL marketing and social media campaigns.

Health-Focused E-Cigarette Technology: 50% of innovative enterprises are focusing on research and development of nicotine-free e-liquids and ceramic-core low-temperature atomization technology.

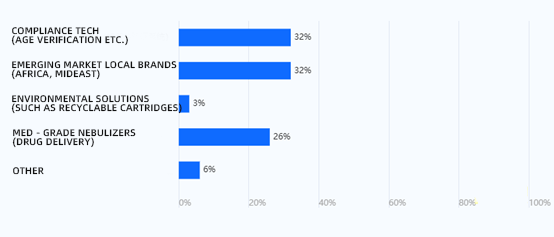

(II) Capital Investment Focus Areas

- Compliance Technology Solutions: Age verification systems and blockchain-based anti-child purchase tracking technologies receive 32% capital interest.

- Emerging Market Startups: E-cigarette startups in Southeast Asia and the Middle East are becoming top priorities for venture capitalists (VCs).

VIII. Industry Development Conclusion and Strategic Recommendations

(я) Core Trends in 2025

The e-cigarette industry in 2025 is projected to evolve under a “North America-led, technology-driven, and compliance-first” model. AI personalization, sustainability, and localization will define brand differentiation.

(II) Strategic Implementation Recommendations

- Market Expansion: Use a dual approach—strengthen North American R&D while cultivating emerging markets such as Indonesia and Nigeria.

- Product Innovation: Launch personalized vape flavors and develop modular hardware to reduce user cost.

- Regulatory Preparedness: Create policy task forces to track changes in PMTA or regional compliance law.

- Supply Chain Scaling: Partner with 3–5 suppliers to cut material costs by 15–20%.

- Brand Messaging: Promote the 95% harm reduction advantage of vaping over smoking through clinical studies to boost trust.